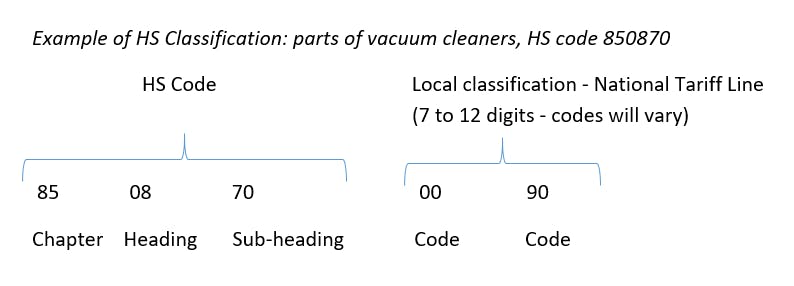

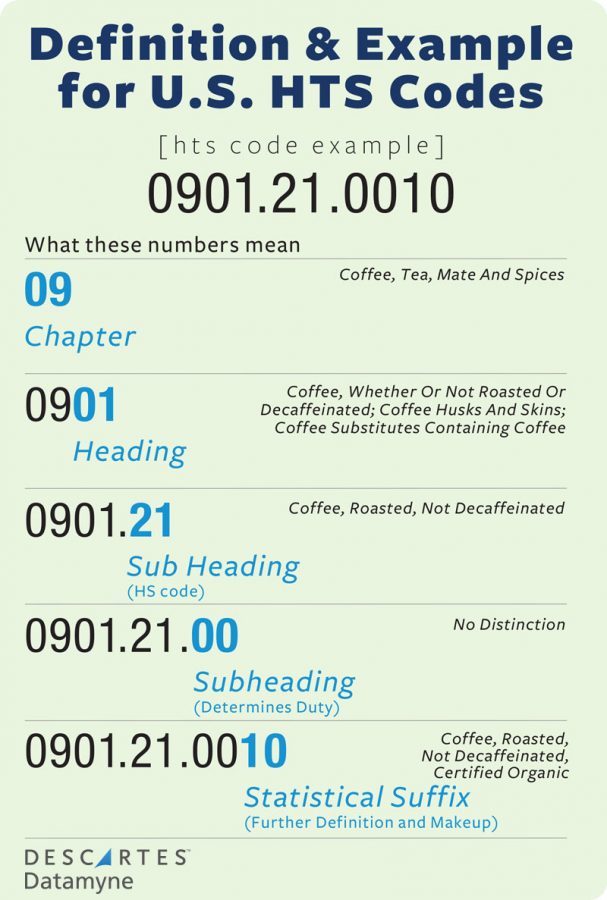

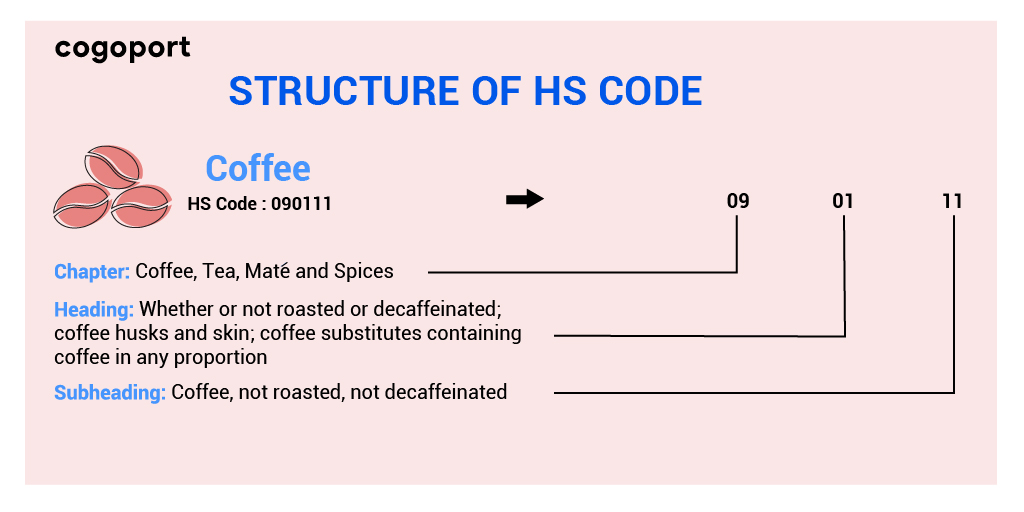

Malaysia custom hs code Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into the customs territory of the US under the terms of US. A HS code or harmonized system number is a 6-digit number used to classify physical goods in cross-border delivery.

Moving Services In Malaysia Docshipper Malaysia

Tax tariff and trade rules in modern times are usually set together because of their common impact on industrial policy investment policy and agricultural policy.

. So customs officials must first classify your cargo based on the products HS Code before. Our Custom Essay Writing Service Features. Basic Duty is a type of duty which is imposed under the Customs Act 1962.

We need more information on the boats you intend to. About RACV Retail Stores Fuel Prices Help Support Contact Back to. Your custom plagiarism free essay doesnt have to be expensive.

It is different from the Harmonized Tariff System Nomenclature which is used by Customs to determine import duties and collect trade data and statistics. The tax collected by Central Board of Indirect Taxes and Customs. Find out the cost of calls for residential customers.

Papers Written From Scratch. The first number of the ECCN identifies the category to which it belongs for example 1 Special. Indian Customs Non-Tariff Notification Number 642022 Customs NT Indian Customs Non-Tariff Notification Number 652022 Customs NT Indian Customs Non-Tariff Notification Number 052022 Customs NT Indian Customs ADD.

Step By Step Guide On Custom Clearance Process. Plusnet residential call tariff guide. The duty rates have already been mentioned in the First Schedule of the Customs Tariff Act 1975 and are amended from time to time under the Finance Act.

General enquiries 13 72 28 Roadside Assistance 13 11 11 Insurance claims 13 19 03 Emergency Home Assist 13 46 63 Online insurance claim. Pelan Antirasuah Organisasi JKDM. With a range of tours cruises hotels and packages and even custom travel available you can book your next holiday with RACV.

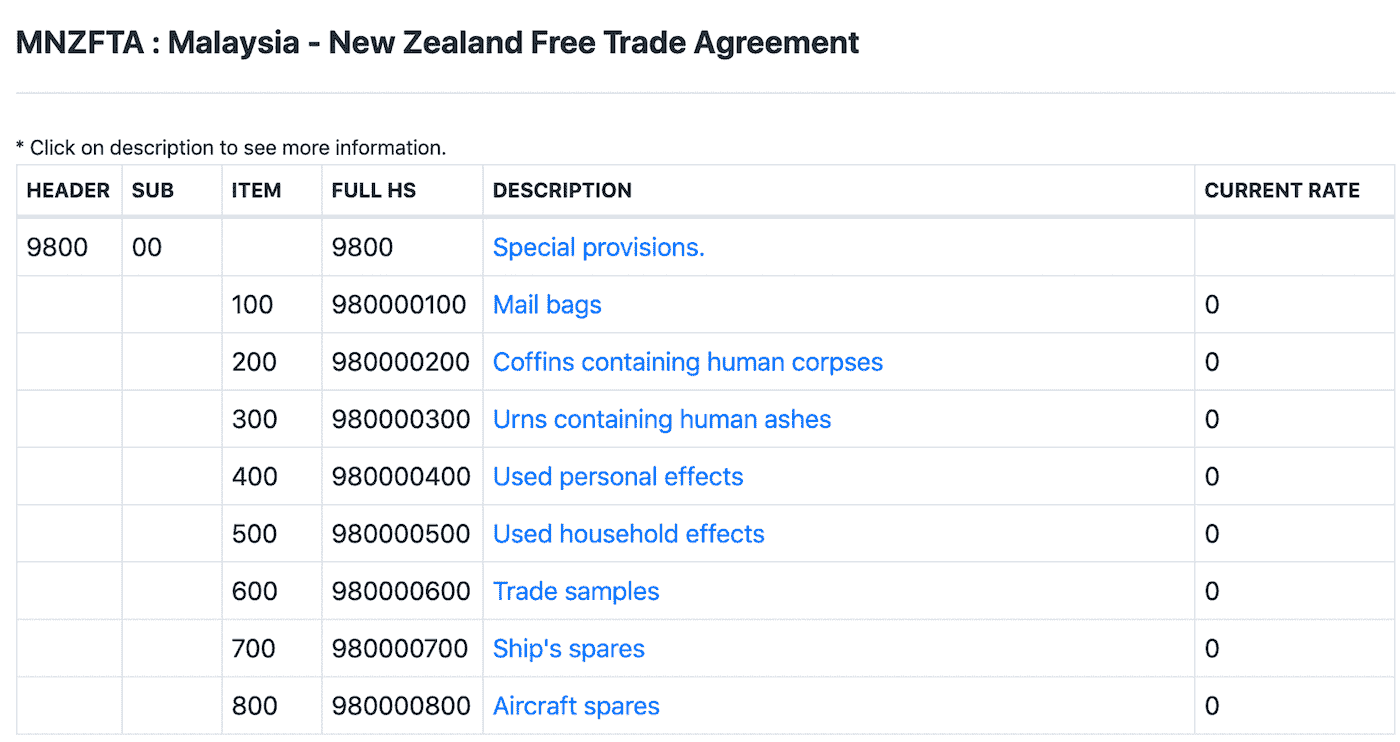

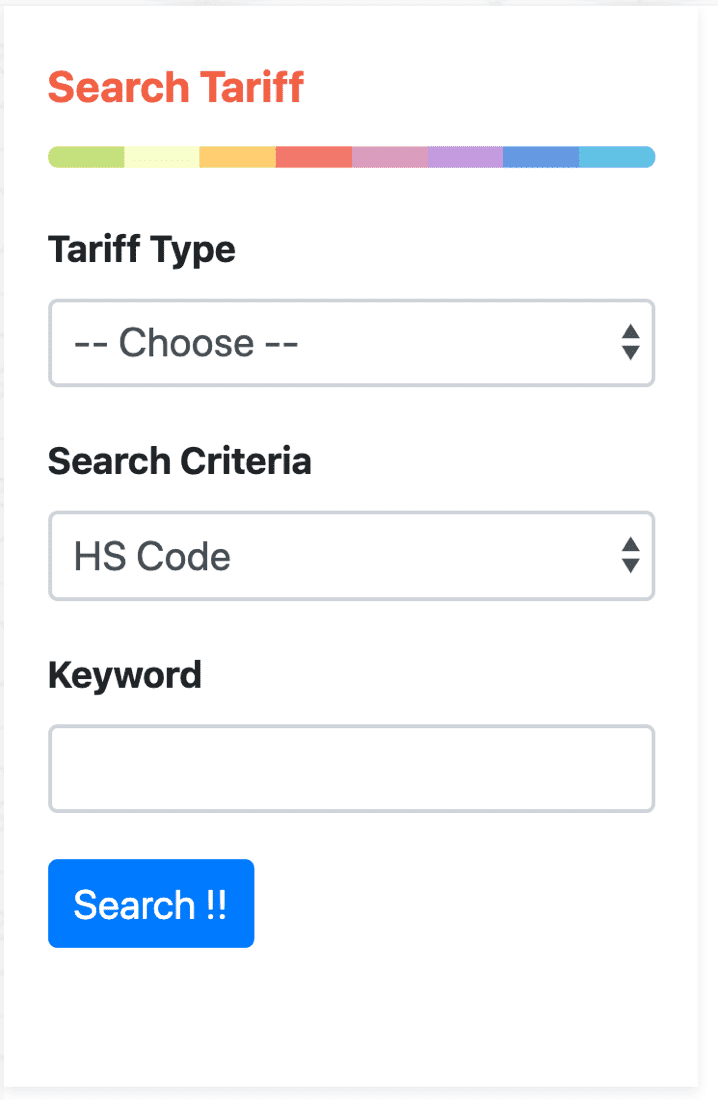

The subsequent two digits identify the Malaysian subheading of the HS code which determines customs duty rates. Trying to get tariff data. 基本 General 暫定 Temporary WTO協定 WTO 特恵 GSP 特別特恵 LDC シンガポール Singapore メキシコ Mexico マレーシア Malaysia チリ Chile タイ Thailand インドネシア Indonesia ブルネイ Brunei アセアン ASEAN フィリピン.

The US code is called a Schedule B number for export goods and a Harmonised Tariff Schedule HTS code for import goods. When goods are exported outside India the tax is known as export custom duty. In China tariff duties for a boat vary a lot depending on the size engine and intended purpose of each boat.

Skip to main content. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. For example in United States 10-digit codes are used where the first six digits are the WCO-provided HS code.

When goods are imported from outside the tax known as import custom duty. In February 2020 as part of Indias. All ECCN have 5 characters for example 1A002 4D003 or 9E102.

15 Normal tax rate. Pages 275 words 000. It varies for different commodities from 5 to 40.

Garis Panduan Pemberian Penerimaan Hadiah JKDM. Its first six digits are an HS Code which is a universal standard used by all countries in their tariff schedule to identify and code internationally traded goods. Note 1b to this subchapter Materials certified to the Commissioner of Customs by authorized military procuring.

For anyone wanting to contact loved ones in Ukraine weve made mobile and landline calls texts and data to and from the region free from 25 February. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division. 関税率 Tariff rate 関税率経済連携協定 Tariff rate EPA 関税率 Tariff rate 単位 Unit 他法令 Law.

100 Value added-tax rate. Malaysia Harmonised System Code structure has up to 10 digits. There are 11 categories on the Strategic Items List.

Jabatan Kimia Malaysia Jalan Sultan 46661 Petaling Jaya Selangor Malaysia. Tariff quota consultation Last tariff QUOTA update. Customs authorities worldwide list tariff duty rates by each products HS Code harmonized system number.

Overall tariff duties for various kinds of tea are the same in the country. Even if a Ukrainian mobile is being used in another country it wont cost Plusnet customers to stay in touch with loved ones. Similarly in India goods for export and import have an eight-digit code called an Indian Tariff Code ITC.

Custom Duty is an indirect tax levied on import or export of goods in and out of country. A trade bloc is a group of allied countries agreeing to minimize or eliminate tariffs against trade with each other and possibly to impose protective tariffs on imports from outside the bloc.

What Is Hs Code The Definitive Faq Guide For 2020

Moving Services In Malaysia Docshipper Malaysia

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

Hts Codes Complete Guide To International Imports 2022

Maintain Tariff Estream Software

Hs Code All About Classification Of Goods In Export Import

The Harmonization Code System Hs Code 630533

Hts Codes Complete Guide To International Imports 2022

How To Calculate Landed Cost For China Imports Cfc

Sst Tariff Code Estream Software

Hs Code All About Classification Of Goods In Export Import

What Is Hs Code The Definitive Faq Guide For 2020

Sst Tariff Code Estream Software

Customs Classification Of Goods Under The Harmonised System Coding Wanfah Prosper Plt 201504000983

Import Duty Malaysia On Sale 55 Off Www Colegiogamarra Com